Key Developments on Tuesday, September 10:

The US Dollar (USD) is showing signs of losing momentum after gaining strength on Monday. While the USD Index remains steady above 101.50 following a 0.4% rise, the recovery seems to be stalling. Meanwhile, the 10-year US Treasury bond yield is fluctuating just above 3.7%. The only major economic data from the US on Tuesday will be the NFIB Business Optimism Index for August, as markets look ahead to the more critical Consumer Price Index (CPI) data on Wednesday.

Asian Market Highlights: China’s Trade Surplus Expands

China’s Trade Data

In the Asian session, China reported that its trade surplus grew to $91.02 billion in August, up from $84.65 billion in July. Exports surged by 8.7% year-over-year, while imports saw a modest increase of 0.5%. Despite the positive trade data, the Australian Dollar (AUD) remained unaffected, with AUD/USD trading slightly higher near 0.6670.

European Market Focus: UK and German Data

UK Employment and Inflation

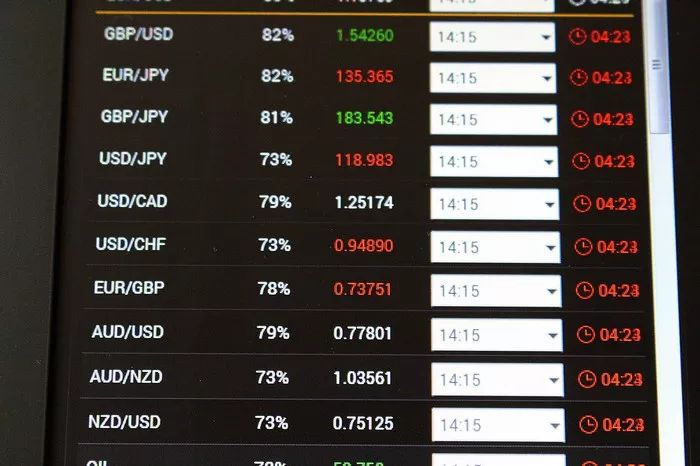

In the UK, the Office for National Statistics (ONS) revealed that the ILO Unemployment Rate dipped to 4.1% in the three months to July, down from 4.2%, aligning with expectations. The Employment Change figure rose significantly to 265,000, up from 97,000. Additionally, annual wage inflation, measured by Average Earnings Excluding Bonus, softened to 5.1% from 5.4%, matching forecasts. In response to this data, GBP/USD recovered from a multi-week low of 1.3050, climbing back toward 1.3100.

Germany’s Inflation Confirmed

Germany’s statistics office, Destatis, confirmed that the Consumer Price Index (CPI) increased by 1.9% year-over-year in August, matching both the initial estimate and market expectations. After closing in negative territory for two consecutive trading sessions, EUR/USD remained steady around 1.1050 in the European morning.

Other Major Currency Mo@vements

USD/JPY

The USD/JPY pair ended Monday in positive territory after snapping a four-day losing streak. The pair continued to gain momentum on Tuesday, trading near 143.50.

Commodities Update: Gold Gains Amid Yield Retreat

After a quiet start to the week, Gold gained traction on Monday as US yields retreated. XAU/USD closed above $2,500 and continues to trade within a narrow range in early European trading on Tuesday.

Outlook: High-Impact US Data on the Horizon

Investors will be closely watching Wednesday’s CPI report from the US, which is expected to drive further market movements. Tuesday’s quieter docket, headlined by the NFIB Business Optimism Index, will set the tone as the week’s major data release approaches.

[inline_related_posts title=”You Might Be Interested In” title_align=”left” style=”list” number=”3″ align=”none” ids=”3636,3579,3621″ by=”categories” orderby=”rand” order=”DESC” hide_thumb=”no” thumb_right=”no” views=”no” date=”yes” grid_columns=”2″ post_type=”” tax=””]