Commodities stocks are an essential part of the global financial market, offering investors a way to participate in the trading of physical goods, such as oil, natural gas, metals, and agricultural products. These stocks are linked to companies involved in the production, extraction, or processing of these raw materials. Understanding commodities stocks is vital for investors looking to diversify their portfolios and hedge against inflation. This article delves into what commodities stocks are, how they function, and why they matter to investors.

Definition of Commodities Stocks

Commodities stocks represent shares in companies whose primary business involves the production or processing of physical commodities. These companies may be engaged in mining, agriculture, oil and gas extraction, or the production of industrial materials like chemicals and steel. By investing in commodities stocks, investors are indirectly investing in the underlying commodities themselves.

While commodities can also be traded directly in futures markets, investing in commodities stocks offers exposure to the commodities sector through the equity market, which can provide more stability compared to the often volatile commodities markets.

Types of Commodities

There are several categories of commodities that drive the performance of commodities stocks:

Energy Commodities: These include oil, natural gas, and coal, which are used to power the global economy.

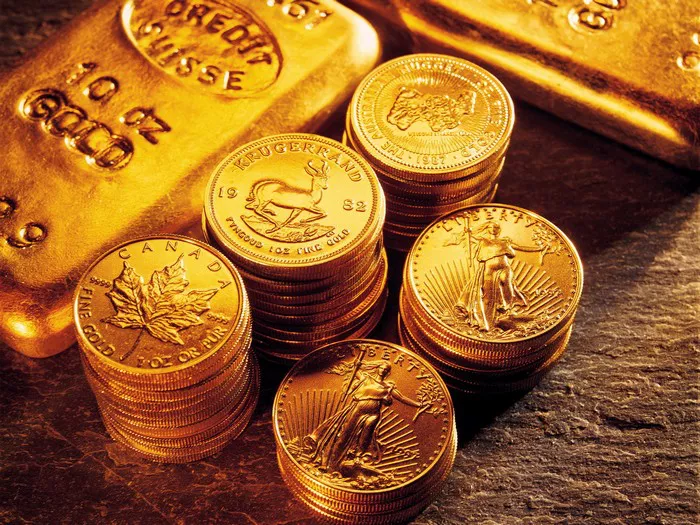

Metals: Precious metals like gold, silver, and platinum, as well as industrial metals like copper, aluminum, and zinc, are key drivers of the global manufacturing sector.

Agricultural Commodities: These include crops like wheat, corn, soybeans, and coffee, as well as livestock such as cattle and hogs.

Soft Commodities: This category covers commodities like cotton, cocoa, and sugar, which are often linked to consumer goods.

Companies involved in any of these areas are considered commodities stocks.

How Commodities Stocks Work

When investors buy commodities stocks, they purchase shares in companies that produce or process commodities. The value of these shares is often closely tied to the price movements of the underlying commodity. For instance, an oil company’s stock price may rise if oil prices increase, as higher prices often lead to increased profits for the company.

However, commodities stocks also factor in company-specific elements such as management efficiency, production costs, and geopolitical risks. This means that while the price of a commodity plays a significant role in determining the stock’s value, it is not the only factor.

Examples of Commodities Stocks

Oil and Gas Companies: ExxonMobil, Chevron, and BP are major energy companies whose stock prices are influenced by the global prices of oil and natural gas.

Mining Companies: Companies like Barrick Gold and Rio Tinto produce gold, copper, and other metals. Their stock prices are influenced by metal prices and production efficiency.

Agricultural Firms: Companies such as Archer Daniels Midland and Bunge are involved in the production and processing of agricultural products, making them important players in the commodities sector.

Why Investors Choose Commodities Stocks

Commodities stocks offer several benefits to investors, particularly those looking for ways to diversify their portfolios or hedge against economic risks like inflation or currency devaluation.

1. Portfolio Diversification

Commodities stocks provide diversification, as their performance is often influenced by different factors than traditional equities or bonds. For example, during periods of rising inflation, commodities like oil, metals, or agricultural products tend to rise in price, offering a buffer for investors who hold commodities-related stocks.

2. Hedge Against Inflation

Historically, commodities have been a hedge against inflation because their prices typically rise when inflation increases. By investing in commodities stocks, investors can potentially benefit from this trend, protecting their portfolios from the eroding effects of inflation on the purchasing power of money.

3. Growth Potential

Many commodities stocks represent companies involved in sectors that are crucial to the global economy. As demand for raw materials continues to grow, companies producing or extracting these materials often see increased revenues and profits. This can lead to growth in stock prices over time, offering attractive returns for investors.

4. Income Generation

Some commodities stocks, particularly those in the energy and mining sectors, offer dividends to shareholders. This can provide a steady income stream for investors, in addition to potential capital gains. Companies such as ExxonMobil and Rio Tinto are known for paying out dividends to shareholders regularly.

Risks of Investing in Commodities Stocks

While commodities stocks offer significant opportunities, they also come with risks that investors need to consider. Understanding these risks is critical to making informed investment decisions.

1. Volatility

Commodities prices can be highly volatile, influenced by factors such as geopolitical events, natural disasters, supply and demand imbalances, and changes in government policies. This volatility can translate to large swings in the prices of commodities stocks, making them a riskier investment compared to other sectors.

2. Exposure to Economic Cycles

Commodities stocks are often highly cyclical, meaning they perform better during periods of economic expansion and struggle during recessions. For example, energy and metal prices often rise when industrial activity is booming but fall during economic slowdowns, leading to fluctuations in the stock prices of companies in these sectors.

3. Geopolitical Risks

Many commodities are produced in politically unstable regions, and geopolitical risks can have a direct impact on the availability and price of certain commodities. For example, oil production in the Middle East or metal mining in Africa can be affected by regional conflicts, leading to price spikes or disruptions in supply.

4. Environmental and Regulatory Risks

Companies involved in commodities production are often subject to strict environmental regulations, which can increase their operating costs. Furthermore, changes in government policies regarding energy use, emissions, or sustainability can affect the profitability of these companies, impacting their stock prices.

See Also: What Are Midcap Stocks?

How to Invest in Commodities Stocks

Investing in commodities stocks can be done through various channels, depending on an investor’s risk tolerance, investment strategy, and financial goals.

1. Individual Stocks

The simplest way to invest in commodities stocks is by purchasing shares of individual companies in the commodities sector. Investors can buy shares in energy companies, mining firms, or agricultural producers, depending on which commodity sector they wish to gain exposure to.

2. Exchange-Traded Funds (ETFs)

ETFs that focus on commodities stocks provide diversified exposure to a basket of companies in the commodities sector. These funds allow investors to spread their risk across multiple companies and commodities. Popular commodities ETFs include the Energy Select Sector SPDR Fund (XLE) and the SPDR Gold Shares (GLD).

3. Mutual Funds

Commodities-focused mutual funds provide a way for investors to gain exposure to commodities stocks through professionally managed portfolios. These funds invest in a wide range of commodities-related companies, providing diversification and professional management.

4. Commodities-Focused Indexes

Investors can also track the performance of commodities stocks through commodities-focused indexes such as the S&P GSCI or the Bloomberg Commodity Index, which track the performance of companies involved in commodities production and trading.

Commodities Stocks vs. Direct Commodities Investment

There are key differences between investing in commodities stocks and directly investing in the commodities themselves, such as through futures contracts or physical commodities like gold bars or oil barrels.

1. Risk and Volatility

Direct commodities investments tend to be more volatile than commodities stocks because they are more directly tied to the supply and demand dynamics of the physical commodity. Commodities stocks, on the other hand, offer some stability as they are tied to the performance of a company, which may have other mitigating factors influencing its stock price.

2. Dividends

One of the key advantages of commodities stocks over direct commodities investments is the potential for dividends. Commodities stocks in sectors like energy and mining often pay dividends, which can provide income to investors, while direct investments in commodities do not generate any income.

3. Access and Liquidity

Commodities stocks are easier to buy and sell than direct commodities investments. Stocks can be traded on major exchanges with high liquidity, whereas investing in physical commodities or futures contracts requires specialized knowledge and may have liquidity constraints.

Conclusion

Commodities stocks provide investors with a unique opportunity to gain exposure to the global commodities market through the equity markets. Whether through individual stocks, ETFs, or mutual funds, commodities stocks offer a way to diversify portfolios, hedge against inflation, and capitalize on the growth of key sectors like energy, metals, and agriculture. However, investors must also be aware of the risks, including volatility, geopolitical factors, and regulatory challenges. By understanding the nature of commodities stocks, investors can make informed decisions and navigate the complexities of the commodities market effectively.

[inline_related_posts title=”You Might Be Interested In” title_align=”left” style=”list” number=”3″ align=”none” ids=”3583,3497,3580″ by=”categories” orderby=”rand” order=”DESC” hide_thumb=”no” thumb_right=”no” views=”no” date=”yes” grid_columns=”2″ post_type=”” tax=””]