Forex trading, also known as foreign exchange trading, is the act of buying and selling currencies to make a profit. In recent years, with the advancement of technology, more and more traders have turned to mobile devices to engage in forex trading. Whether you’re new to forex or an experienced trader looking for a convenient way to trade, using your phone is a great option. In this article, we will guide beginners through the steps and key considerations of trading forex using your phone.

Understanding Forex Trading

Before diving into trading on your phone, it is essential to understand what forex trading is. Forex trading involves the exchange of currencies in the global market. The forex market is the largest financial market in the world, with an average daily trading volume exceeding $6 trillion. The goal of forex trading is to take advantage of price fluctuations in currency pairs.

When you trade forex, you’re essentially speculating on whether a particular currency will rise or fall in value relative to another currency. For example, if you believe the value of the Euro will rise against the US Dollar, you would buy the EUR/USD pair. If the Euro rises, you make a profit. If it falls, you incur a loss.

Getting Started with Forex Trading on Your Phone

Forex trading on your phone can be both convenient and effective. With a smartphone or tablet, you can trade from anywhere at any time, as long as you have access to the internet. Here are the steps to get started:

1. Choose a Reliable Forex Broker

The first step in getting started with forex trading is selecting a reliable broker. A forex broker is an intermediary between you and the market, providing you with the platform to execute trades. Some key factors to consider when choosing a broker are:

Regulation: Choose a broker that is regulated by a recognized authority such as the Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC). This ensures that the broker adheres to certain standards of integrity and transparency.

Trading Platform: Ensure the broker offers a mobile-friendly trading platform with a user-friendly interface and a range of features that can help you manage your trades effectively.

Customer Support: Good customer support is crucial for addressing any issues you might encounter while trading. Make sure the broker offers responsive and accessible customer support channels.

2. Download the Trading App

Once you’ve chosen a broker, the next step is to download their trading app. Most forex brokers have their own mobile applications or offer popular third-party trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These apps are available on both Android and iOS devices and are designed to give you full access to the forex market from the convenience of your phone.

When selecting a trading app, ensure that it offers the following features:

Real-time market data: This allows you to stay updated on price movements.

Charting tools: Essential for analyzing currency pairs and making informed trading decisions.

Order execution capabilities: This ensures that you can place and manage orders quickly and efficiently.

Security features: Look for apps with strong encryption to protect your financial information.

3. Open a Demo Account

Before risking real money, it’s recommended to open a demo account. A demo account allows you to practice trading with virtual money, giving you a risk-free way to familiarize yourself with the app and the forex market. Use the demo account to:

- Learn how to navigate the trading platform.

- Experiment with different strategies.

- Get a feel for the market’s volatility and how currency pairs move.

4. Fund Your Account

Once you are comfortable with the demo account, the next step is to fund your live trading account. Forex brokers typically offer several deposit options, including bank transfers, credit/debit cards, and e-wallets. When funding your account, consider the following:

Minimum deposit requirements: Some brokers have low minimum deposit requirements, making it easier for beginners to start.

Transaction fees: Ensure that you are aware of any fees associated with deposits and withdrawals.

Payment processing times: Choose a payment method that processes quickly to avoid delays in funding your account.

5. Learn the Basics of Forex Trading

Forex trading is complex and requires a solid understanding of various concepts. As a beginner, it’s important to familiarize yourself with the basic terminology and concepts of forex trading, such as:

Currency pairs: Forex trading involves trading pairs of currencies. For example, the EUR/USD represents the Euro against the US Dollar.

Pip: A pip is the smallest unit of price movement in the forex market.

Leverage: Leverage allows you to control a large position with a smaller amount of capital. However, it also increases the risk of significant losses.

Spread: The spread is the difference between the bid price and the ask price of a currency pair.

By understanding these basics, you will be better equipped to make informed decisions when trading on your phone.

Making Your First Trade

Once you’re familiar with the basics of forex trading, you can start making your first trade. Here’s a simple process for executing your first trade on your phone:

1. Choose a Currency Pair

The first step in placing a trade is selecting a currency pair to trade. As a beginner, it’s best to start with major currency pairs, such as EUR/USD, GBP/USD, or USD/JPY. These pairs tend to have more liquidity and lower spreads, making them less risky for new traders.

2. Analyze the Market

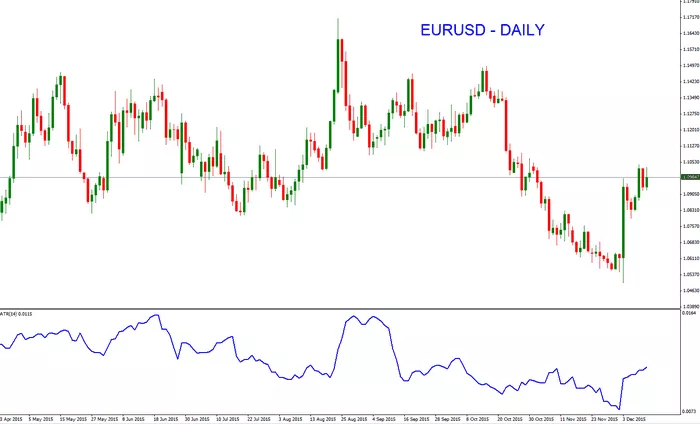

Before making a trade, it’s essential to analyze the market. Use the charting tools provided by the trading app to analyze price movements, trends, and potential entry and exit points. Technical analysis, such as looking for support and resistance levels, can help guide your decisions.

3. Place an Order

Once you’ve identified a good trade opportunity, you can place an order. On most mobile apps, you can place a market order or a limit order. A market order is executed immediately at the current market price, while a limit order is placed at a specific price level and will only be executed when the market reaches that price.

4. Set Stop Loss and Take Profit

To manage risk, it’s important to set a stop loss and take profit. A stop loss is an order to automatically close a trade if the price moves against you, limiting your loss. A take profit is an order to close the trade when the price reaches a certain profit level.

5. Monitor Your Trade

After placing your order, you can monitor the trade in real time using your trading app. Keep an eye on price movements and adjust your stop loss or take profit if necessary. It’s important to avoid being too emotional while trading, as impulsive decisions can lead to losses.

Key Strategies for Beginners

As a beginner, it’s important to adopt strategies that are simple yet effective. Here are a few strategies that can help you succeed in forex trading on your phone:

1. Start Small

As a beginner, it’s essential to start with small trades until you become more comfortable with the market. Avoid using high leverage or placing large trades, as this increases the risk of significant losses.

2. Follow Trends

A simple strategy that works for beginners is trend-following. This strategy involves identifying the overall market trend (uptrend or downtrend) and trading in the direction of that trend. Trend-following can help you avoid trading against the market, which can be risky for new traders.

3. Risk Management

Risk management is crucial for success in forex trading. A good rule of thumb is to risk no more than 1-2% of your account balance on each trade. This ensures that a string of losses won’t deplete your entire account.

4. Use Technical Analysis

Technical analysis involves analyzing past price movements to predict future price action. As a beginner, focus on simple technical indicators such as moving averages and Relative Strength Index (RSI). These indicators can help you identify trends and overbought/oversold conditions.

5. Avoid Overtrading

Overtrading is one of the most common mistakes that beginners make. It occurs when traders place too many trades, often driven by emotion. Stick to your trading plan, and avoid impulsive decisions. Trading is about quality, not quantity.

Conclusion

Forex trading on your phone offers a convenient and accessible way for beginners to engage in the forex market. By selecting a reliable broker, using a mobile-friendly trading app, and familiarizing yourself with the basics of forex trading, you can start trading from the comfort of your phone. Remember to start small, focus on risk management, and always practice with a demo account before risking real money. With patience, practice, and discipline, you can become a successful forex trader.

Related topics: