In the exciting and often complex world of stock trading, technical analysis plays a crucial role in helping investors make decisions. One of the commonly observed and useful patterns in technical analysis is the bull flag. Understanding what a bull flag is and how to identify and utilize it can give traders an edge in predicting potential upward movements in stock prices. Whether you’re a novice investor just starting to explore the stock market or an experienced trader looking to expand your toolkit of analysis techniques, getting to grips with the bull flag pattern is well worth your time.

What Exactly is a Bull Flag?

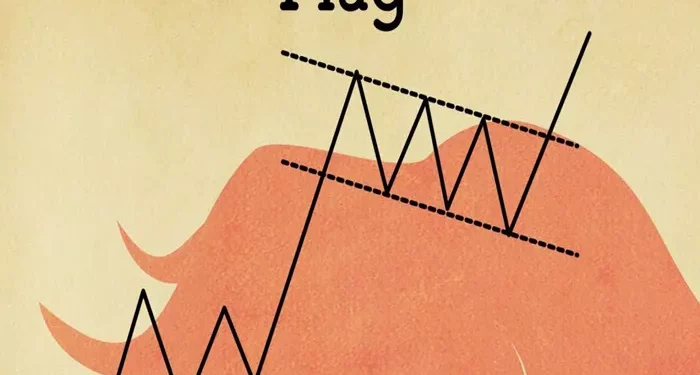

A bull flag is a continuation pattern that appears on a stock’s price chart. Essentially, it’s a visual representation that suggests the stock’s upward trend is likely to continue after a brief pause or consolidation period. Think of it like a flag on a pole. The initial strong upward movement of the stock price forms the “pole,” and then the subsequent period of sideways or slightly downward movement creates the “flag.”

For example, let’s say a stock has been steadily rising in price over several days or weeks. This sharp upward move is the pole. But then, instead of continuing to shoot up right away, the price starts to trade within a relatively narrow range, moving sideways or perhaps even dipping a little bit. This period of consolidation is the flag. Once the flag formation is complete, there’s often a good chance that the stock will resume its upward climb, just like a flag on a pole starts flapping again when the wind picks back up.

Anatomy of a Bull Flag

1. The Pole

The pole of a bull flag is created by a strong and rapid upward price movement. This usually occurs on high trading volume, which indicates significant buying interest in the stock. The steeper the pole, the more powerful the initial upward momentum. For instance, if a stock’s price jumps from $10 to $15 in just a few trading days with a lot of shares being bought and sold each day, that’s a clear formation of a pole. It shows that there’s strong demand for the stock, and investors are willing to pay higher prices to get their hands on it.

During the formation of the pole, it’s common to see news or events that drive the enthusiasm for the stock. Maybe the company has announced better-than-expected earnings, a new product launch that’s expected to be a big hit, or a major contract win. All these positive developments can fuel the rapid price increase that forms the pole.

2. The Flag

The flag is the consolidation phase that follows the pole. It typically has a rectangular or slightly sloping shape on the price chart. The price movements during this time are much more subdued compared to the pole. The stock might trade within a range of just a few cents or dollars for several trading sessions.

The flag can slope slightly downward, which is actually quite common. This downward slope doesn’t mean the trend has reversed; rather, it’s just a sign of a temporary pause as some investors take profits or others wait for more confirmation before jumping back in. The trading volume during the flag formation usually decreases from the high volume seen during the pole. This lower volume indicates that the market is taking a breather and digesting the previous rapid move.

For example, if the stock that had shot up to $15 during the pole then trades between $14.50 and $15.20 for the next week or so with lower trading volume, that’s the flag being formed.

Why Does a Bull Flag Pattern Form?

1. Profit-Taking and Consolidation

After the initial sharp upward move in the pole phase, many investors who bought the stock at lower prices may decide to take their profits. This selling pressure can cause the price to stop rising and start consolidating. At the same time, other investors who missed out on the initial rally might be waiting on the sidelines to see if the upward trend is really sustainable. They’re hesitant to jump in right away, which also contributes to the slower trading and the formation of the flag.

For instance, imagine a group of traders who bought a stock at $10 and saw it quickly rise to $15. They might think it’s a good time to cash out and lock in their gains. Meanwhile, new investors are looking at the stock and thinking, “Is this just a short-lived spike, or will it keep going up?” So, they hold off on buying until they get more signals, and this creates the pause in the price action that forms the flag.

2. Market Sentiment and Expectations

The overall market sentiment also plays a role in the formation of a bull flag. If the broader market is showing signs of uncertainty or if there’s some news that affects the sector the stock belongs to, it can cause the stock to take a break from its upward trend and form a flag. However, if the underlying fundamentals of the company remain strong and the positive sentiment that drove the initial pole still exists, the flag is just a temporary pause before the stock resumes its climb.

Say there’s some talk in the market about potential changes in regulations that could impact the industry the company operates in. This might make some investors a bit cautious, even if the company itself has good prospects. So, the stock price consolidates in a flag pattern while the market waits to see how things will play out.

How to Identify a Bull Flag

1. Chart Observation

The first step is to look at the stock’s price chart. You need to spot the clear formation of a pole, which is that sharp upward price movement. Then, look for the subsequent period of consolidation that forms the flag. The flag should have relatively parallel upper and lower boundaries on the chart. If it’s sloping, it should still maintain a consistent shape over a few trading sessions.

For example, on a daily chart, you can see if the stock had a strong run-up in price over a week or two (the pole) and then started trading in a narrow range for the next several days (the flag). You can use charting tools available on most trading platforms to help you draw lines along the boundaries of the flag to clearly visualize the pattern.

2. Volume Analysis

Volume is a crucial factor in confirming a bull flag. As mentioned earlier, the pole should form on high volume, showing strong buying interest. During the flag formation, the volume should decrease. When the stock is about to break out of the flag and resume its upward trend, you’ll often see the volume start to pick up again. This increase in volume as the stock breaks out is a key signal that the bull flag pattern is likely to play out as expected.

So, if you notice that the trading volume during the flag is much lower than during the pole and then starts to spike as the price starts to move higher again, it’s a good indication that you’ve identified a valid bull flag.

3. Time Frame Consideration

Bull flag patterns can form over different time frames. They can appear on short-term charts like 15-minute or hourly charts for day traders who are looking for quick trading opportunities. Or, they can form on daily, weekly, or even monthly charts for longer-term investors. The key is to make sure that the pattern is consistent within the chosen time frame.

For example, a day trader might look for bull flag patterns on an hourly chart to make trades within a single trading day. While a long-term investor might study weekly charts to identify bull flag formations that could signal a continued upward trend over several months or years.

Trading Strategies Using the Bull Flag Pattern

1. Entry Points

Once you’ve identified a bull flag and are confident that it’s a valid pattern, the next step is to decide when to enter a trade. A common approach is to enter a long position (buy the stock) when the price breaks above the upper boundary of the flag. This breakout indicates that the stock is likely resuming its upward trend. You can set a stop-loss order just below the lower boundary of the flag to limit your potential losses in case the breakout fails.

For instance, if the upper boundary of the flag is at $15.50, you might place a buy order when the price crosses above that level. And set a stop-loss at around $14.50, which is below the flag’s lower boundary, to protect yourself if the stock doesn’t perform as expected.

2. Profit Targets

Setting profit targets is also important. One way is to measure the length of the pole and project that same distance from the breakout point. So, if the pole was a $5 increase in price (from $10 to $15), you might expect the stock to continue rising by another $5 from the breakout point. Another approach could be to look at key resistance levels on the chart, such as previous highs or round numbers, and aim to take profits when the stock reaches those levels.

For example, if the breakout occurs at $15.50 and the pole was a $5 move, you might set a profit target at $20.50. Or, if there’s a previous high at $18 that the stock hasn’t been able to break through in the past, you could decide to take profits when it approaches that level.

3. Risk Management

Risk management is crucial when trading based on the bull flag pattern. In addition to setting stop-loss orders, you should also consider the size of your position relative to your overall portfolio. Don’t risk too much capital on a single trade based on the bull flag. You can calculate your risk-reward ratio for each trade to ensure that the potential reward justifies the risk you’re taking.

For example, if your stop-loss is set at $14.50 and your profit target is at $20.50, your risk is $1 per share ($15.50 – $14.50) and your reward is $5 per share ($20.50 – $15.50). This gives you a risk-reward ratio of 1:5, which is generally considered favorable.

Limitations of the Bull Flag Pattern

1. False Signals

Like many technical analysis patterns, the bull flag isn’t foolproof. There can be false signals where the stock appears to form a bull flag but then doesn’t break out as expected or actually reverses and starts trending downward. This can happen due to sudden changes in company fundamentals, unexpected market events, or just random market fluctuations.

For example, a company might announce a recall of one of its products just as the stock is about to break out of the flag. This negative news can quickly change the market sentiment and cause the stock to drop instead of continuing its upward trend.

2. Subjectivity in Identification

Identifying a bull flag can be somewhat subjective. Different traders might draw the boundaries of the flag slightly differently or have different interpretations of whether a particular price movement constitutes a valid pole or flag. This subjectivity can lead to differences in trading decisions and outcomes.

Say two traders are looking at the same stock chart. One might see a clear bull flag formation based on their analysis, while the other might think the price movements are too irregular to be considered a proper bull flag.

Conclusion

The bull flag pattern is a valuable tool in the world of stock trading and technical analysis. It can provide traders with insights into potential continued upward trends in stock prices. By understanding its anatomy, how to identify it, and how to use it in trading strategies while also being aware of its limitations, investors can make more informed decisions and potentially improve their trading results. Whether you’re focused on short-term gains or building a long-term investment portfolio, incorporating the analysis of bull flag patterns can add another dimension to your trading approach. However, it’s important to remember that no single pattern or technique guarantees success in the stock market, and a comprehensive approach that considers multiple factors is always advisable.

Related topics: