Gold has long been a prized asset in India, both for its cultural significance and as a valuable investment. However, bringing gold into the country is subject to certain regulations and limits set by the government. For travelers, it’s essential to understand how much gold they can legally carry, as well as the taxes and duties that may apply. In this article, we will explore the legal framework surrounding the import of gold into India, the restrictions imposed, and how travelers can comply with these rules.

Understanding Gold Import Regulations in India

India’s gold import regulations are established by the government to maintain control over the amount of gold entering the country and to curb illegal smuggling. These regulations apply to anyone traveling into India, whether they are Indian citizens or foreigners. The rules around carrying gold to India have evolved over time, and they are often updated to reflect the economic and fiscal priorities of the country.

Who Can Carry Gold to India?

Any individual entering India—whether Indian citizens returning from abroad or foreign nationals visiting the country—can carry gold, but the quantity and the applicable duties differ based on several factors. These include the person’s residency status, the length of time they have spent outside India, and the form in which the gold is being brought.

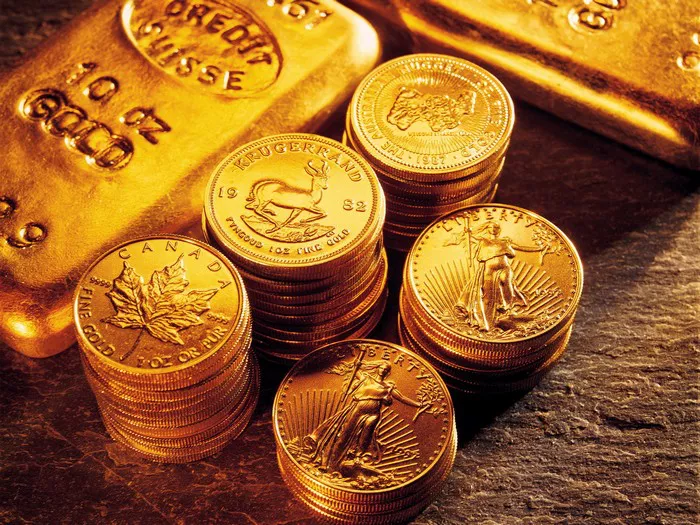

Types of Gold Permitted: Travelers can bring in gold in various forms, such as:

- Jewelry

- Gold coins

- Gold bars and biscuits

However, there are restrictions and specific rules for each of these forms, which will be detailed later in this article.

Resident vs. Non-Resident Status

The amount of gold that can be brought into India, and the taxes or duties levied, differ based on whether the individual is classified as a Resident Indian (someone who lives in India for at least 182 days in the preceding financial year) or a Non-Resident Indian (NRI).

Non-Resident Indians:

NRIs can bring gold to India, but there are limits on the quantity they can carry without paying customs duty. If they exceed the allowed limit, they will have to pay taxes or import duties.

Foreign Nationals:

Foreign visitors can also bring gold into India, though the limits and duties will apply in the same way as they do to NRIs.

Gold Carrying Limits for NRIs and Residents

How Much Gold Can You Bring Duty-Free?

The Indian government allows NRIs and returning Indian citizens to carry a specific amount of gold without having to pay any customs duty. This duty-free allowance is differentiated by gender:

For Male Passengers: Up to 20 grams of gold, with a maximum value of ₹50,000 (approximately $600 USD), can be brought duty-free.

For Female Passengers: Up to 40 grams of gold, with a maximum value of ₹100,000 (approximately $1,200 USD), can be brought without paying customs duty.

It’s important to note that these duty-free allowances are applicable only if the gold is being brought in as jewelry. Gold bars, coins, and biscuits do not qualify for the duty-free allowance.

Maximum Gold Allowance with Duty

If you are bringing in more gold than the duty-free limit, you are required to declare it to customs authorities and pay the applicable duties.

For Gold Jewelry: There is no upper limit on how much gold jewelry you can bring into India, as long as you are prepared to pay customs duty on any amount exceeding the duty-free limit.

For Gold Bars, Coins, and Biscuits: The maximum amount of gold you can bring into India is 1 kg (1000 grams) per person. This limit applies regardless of whether the gold is in the form of bars, coins, or biscuits. Any amount exceeding this will not be allowed into the country.

Customs Duty on Gold

Duty Rates

If you are carrying more than the duty-free limit of gold, you will have to pay customs duty. The duty rate on gold is subject to change based on the government’s fiscal policies, but as of the latest update, the rate is as follows:

Customs Duty on Gold: 12.5% of the gold’s value

Social Welfare Surcharge: 3% of the customs duty

Together, these add up to a significant amount, which is why it is crucial to accurately assess the value of the gold being brought into India.

How Is the Value of Gold Calculated?

The customs duty is calculated based on the gold’s value, which is determined by the price of gold on the day of your arrival in India. Customs officials will assess the value of your gold based on international gold prices and convert it into Indian rupees for the calculation of duty.

Declaration Process at Customs

When arriving at an Indian airport, if you are carrying more than the duty-free limit of gold, you must declare it to the customs authorities. There are designated “Red Channels” at international airports in India where you can declare goods that exceed the permitted limits. Failing to declare gold can result in confiscation, fines, or other legal penalties.

See Also: What Does Real Gold Look Like?

Special Considerations for Gold Carriage

Duration of Stay Abroad

If you are an NRI or Indian citizen returning from abroad, you must have been away from India for at least six months to qualify for the duty-free allowance. This rule is in place to prevent frequent short trips with gold imports and ensures that only those who have spent a significant amount of time abroad can benefit from the duty exemptions.

Proof of Purchase

When bringing gold into India, especially in large quantities, it is advisable to carry proof of purchase or ownership. This is particularly important for gold bars, coins, or biscuits, as customs officials may ask for documentation to ensure that the gold has been legally acquired and is not the result of smuggling or other illicit activities.

Penalties for Non-Compliance

Seizure of Gold

If you fail to declare gold or if the quantity exceeds the permitted limits, the gold may be seized by customs authorities. Depending on the severity of the infraction, you may face fines, confiscation, or other legal action.

Monetary Fines

In addition to confiscation, travelers may be subject to significant monetary fines if they attempt to bring undeclared gold into the country. These fines are typically a percentage of the value of the undeclared gold.

Smuggling Consequences

Attempting to smuggle gold into India without following the correct procedures can have serious legal consequences. In addition to the gold being confiscated, individuals caught smuggling gold may face criminal charges, imprisonment, or heavy fines.

Tips for Travelers Carrying Gold to India

Be Aware of the Limits

Always check the latest rules and regulations before carrying gold to India. Customs laws may change, and being up-to-date will help you avoid any unexpected surprises upon arrival.

Carry Documentation

Always carry proof of purchase or documentation showing the origin of the gold you are bringing into India. This will help customs officials verify the legality of the gold and expedite the process.

Declare Gold Properly

If you are carrying more gold than the duty-free limit, ensure that you declare it upon arrival. Use the Red Channel at the airport to avoid penalties and ensure a smooth process.

Understand the Duty Fees

Calculate the customs duty fees ahead of time so you are aware of how much you may need to pay upon entry. Understanding the costs will help you avoid any financial shocks when passing through customs.

Conclusion

Bringing gold to India is a common practice, but it is essential to be aware of the legal limits and customs duties associated with it. While NRIs and residents can bring a certain amount of gold duty-free, exceeding these limits requires paying a hefty customs duty. Understanding the rules, staying updated on current regulations, and complying with the declaration process are crucial steps to avoid legal issues when transporting gold into India.

Whether you are carrying gold as an investment, a gift, or for personal use, ensuring that you adhere to India’s customs regulations will allow you to travel with peace of mind and avoid unnecessary complications at the border.

[inline_related_posts title=”You Might Be Interested In” title_align=”left” style=”list” number=”3″ align=”none” ids=”3549,3647,3514″ by=”categories” orderby=”rand” order=”DESC” hide_thumb=”no” thumb_right=”no” views=”no” date=”yes” grid_columns=”2″ post_type=”” tax=””]